Section 194T: TDS on payment to partners by firms-Partnership firms or LLP

Section 194T: TDS on payment to partners by firms-Partnership firms or LLP

Section 194T: TDS on payment to partners by firms-Partnership firms or LLP

Section 194T: TDS on payment to partners by firms-Partnership firms or LLP

Earlier, TDS was not applicable on partner’s remuneration, interest, commission etc. However, TDS was applicable on payments made to employees by firms. A new Section 194T (Payments to partners of firms) for TDS deduction proposed as per Clause 62 of the Finance (No. 2) Bill, 2024, which expands the scope of TDS to include payments made by firms to its partners.

Applicability of TDS u/s 194T

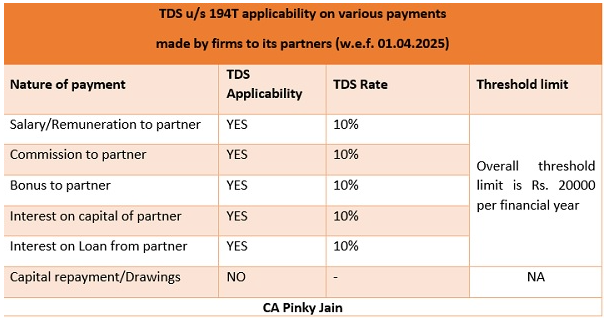

Effective from 1st April, 2025, Section 194T mandates TDS deduction on various payments made by firms (Partnership firms or LLP) to its partners. These payments include salary, remuneration, commission, bonus, and interest on any account.

Important Note: TDS is not applicable on the drawings or capital repayment to partners. But TDS applicable on interest on capital or loan from partner.

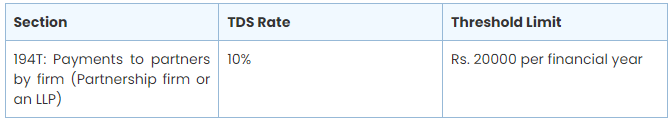

TDS Rate and Threshold Limit

Firms are required to deduct TDS at a rate of 10% on payments made to partners if the aggregate amount exceeds Rs. 20,000 in a financial year.

Please note that TDS will be applicable on whole amount if aggregate exceeds the threshold limit.

For instance, if a partnership firm/LLP pays Rs. 5,00,000 to a partner as remuneration in a financial year, the TDS under Section 194T would amount to Rs. 50,000 (i.e., 10% of Rs. 5,00,000).

When to Deduct TDS u/s 194T?

The TDS is to be deducted at the earliest of the following dates:

Credit to the account (including capital account) of partner in the books of the firm or Payment to the partner

Whether TDS u/s 194T applicable on an LLP?

Yes, Section 194T is applicable to firms, including partnership firms and LLPs.

As per Section 2(23)(i) the Income Tax Act, 1961, “firm” shall have the meaning assigned to it in the Indian Partnership Act, 1932 (9 of 1932), and shall include a limited liability partnership as defined in the Limited Liability Partnership Act, 2008 (6 of 2009).

As per Section 2(23)(ii) the Income Tax Act, 1961, “partner” shall have the meaning assigned to it in the Indian Partnership Act, 1932 (9 of 1932), and shall include,-

(a) any person who, being a minor, has been admitted to the benefits of partnership; and

(b) a partner of a limited liability partnership as defined in the Limited Liability Partnership Act, 2008 (6 of 2009)

Why TDS u/s 192 not applicable on partners salary or remuneration?

As per Explanation 2 of Section 15 of Income Tax act for Salaries: Any salary, bonus, commission or remuneration, by whatever name called, due to, or received by, a partner of a firm from the firm shall not be regarded as “salary” for the purposes of this section. Hence, no TDS liability was there on partner’s salary or remuneration u/s 192.

Conclusion

In summary, Section 194T represents India’s on going effort to modernize tax laws, enhancing transparency and accountability in financial transactions between firms and their partners. The introduction of Section 194T marks a departure from previous norms where TDS was not applicable on partner payments, now extending to both partnership firms and LLPs.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH